nj property tax relief homestead benefit

To qualify you must be a homeowner or mobile homeowner and satisfy income limitations for a particular year she said. Must make application annually with the State of New Jersey.

Nj Property Tax Relief Program Updates Access Wealth

State of NJ Homestead Benefit.

. NEW JERSEY - New Jersey Gov. The following chart shows the mailing schedule for the 2018 Homestead Benefit filing information packets. Property Tax Relief Programs.

The program was restored in the approved budget that went into effect on October 1 2020. Make sure to save it. Check or Direct Deposit.

To file an application online or get more information click here. 75000 for homeowners under 65 and not blind or disabled. Under a proposal Murphy unveiled Thursday New Jersey homeowners making up to 250000 annually would be eligible to receive state-funded property-tax relief benefits.

Homeowners and certain tenants may be eligible. New Jersey homeowners will not receive Homestead property tax credits on their Nov. File Online or by Phone.

The filing deadline for the latest Homestead Benefit Application - Tax Year 2018 - was November 30 2021. The Senior Freeze program offers a property tax reimbursement to eligible seniors 65 and older or disabled individuals said Cynthia Fusillo. To put this in perspective the average NJ citizen paid approximately 8861 in taxes in 2019.

75000 for homeowners under age 65 and not blind or disabled. That would add at least 100000 to the current income cutoffs for direct property-tax relief benefits. However the total of all property tax relief benefits that you receive for 2021 Senior Freeze Homestead Benefit Property Tax Deduction for senior citizensdisabled persons and Property Tax.

Property Tax Relief Programs Homestead Benefit. Murphy said his administration plans to ramp up the program over a three-year period and the state investment would. You owned and occupied a home in New Jersey that was your principal residence main home on October 1 2018.

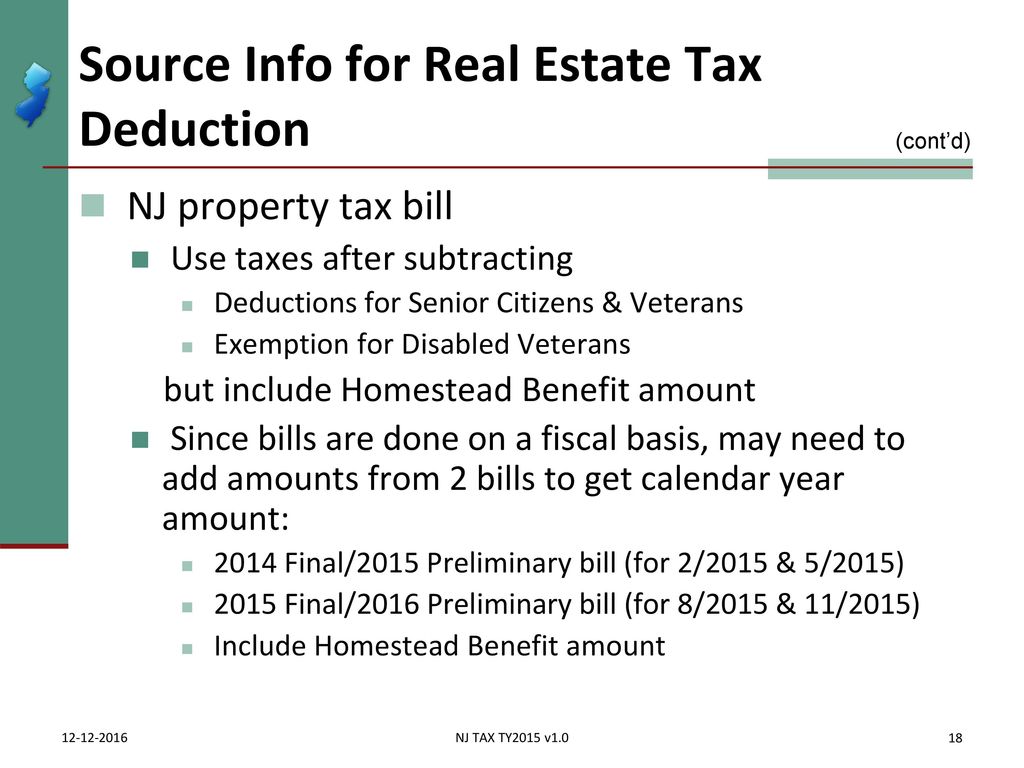

Email Delivery Expected to Begin. The State of NJ site may contain optional links information services andor content from other websites operated by third parties that are provided as a convenience such as Google Translate. 1 real estate tax bills a state treasury official said Wednesday.

Multiplying the amount of your 2017 property taxes paid up to 10000 by 5. To apply for the refund complete and submit the Application for Refund of Property Tax es PDF and mail or fax it to the Department of Tax ation PO. Increasing that income threshold would allow the Murphy administration to.

The Homestead Benefit program provides property tax relief to eligible homeowners. Box 805 Jersey City NJ 07302-0505. You can file for a Homestead Benefit regardless of your income but if it is more than the amounts above we will deny your application.

For information call 888-238-1233. Applications for the deduction can be obtained from the City of Elizabeth Tax Assessors Office. E-mail the state for Homestead rebate questions.

A certified public accountant with Lassus Wherley in New Providence. Own and occupy a home in NJ that was their principal residence on October 1 of the pre-tax year. If your primary residence is in New Jersey and you paid your property taxes in the year you may be able to get a tax credit of up to 1000.

Allow at least two weeks after the expected delivery date for your county before contacting the Homestead Benefit Hotline at 1-888-238-1233 or visiting a Regional Information Center for help. To file an application by phone please call 1-877-658-2972. Senior citizen disabled person and surviving spouses receive an annual post tax year income verification Form PD5 in January.

Property must be your principal residence. General qualifications are as follows. Forms are sent out by the State in mid-April.

Funding for the property tax relief program. A 250 yearly deduction is available for senior citizens disabled persons and surviving spouses of a senior. Over 100000 But not over 150000.

Phil Murphy announced more homeowners and renters would receive property tax relief under his new program- ANCHOR- which would replace the Homestead Benefit Program. Prior Year Homestead Benefit Information. New Jerseys Property Tax Relief Programs Joyce Olshansky Team Leader.

Ad 2022 Homeowner Relief Program is Giving a One Time 3627 StimuIus Check. Homestead Benefit 1-888-238-1233 Property Tax Reimbursement 1-800-882-6597. If its approved by fellow Democrats who.

If you were not a homeowner on October 1 2017 you are not eligible for a Homestead Benefit even if you owned a home for part of the year. Credit on Property Tax Bill. Unlike Hawaii Alabama and Colorado which are states with the lowest property taxes New Jersey has one of the highest tax rates in the country219.

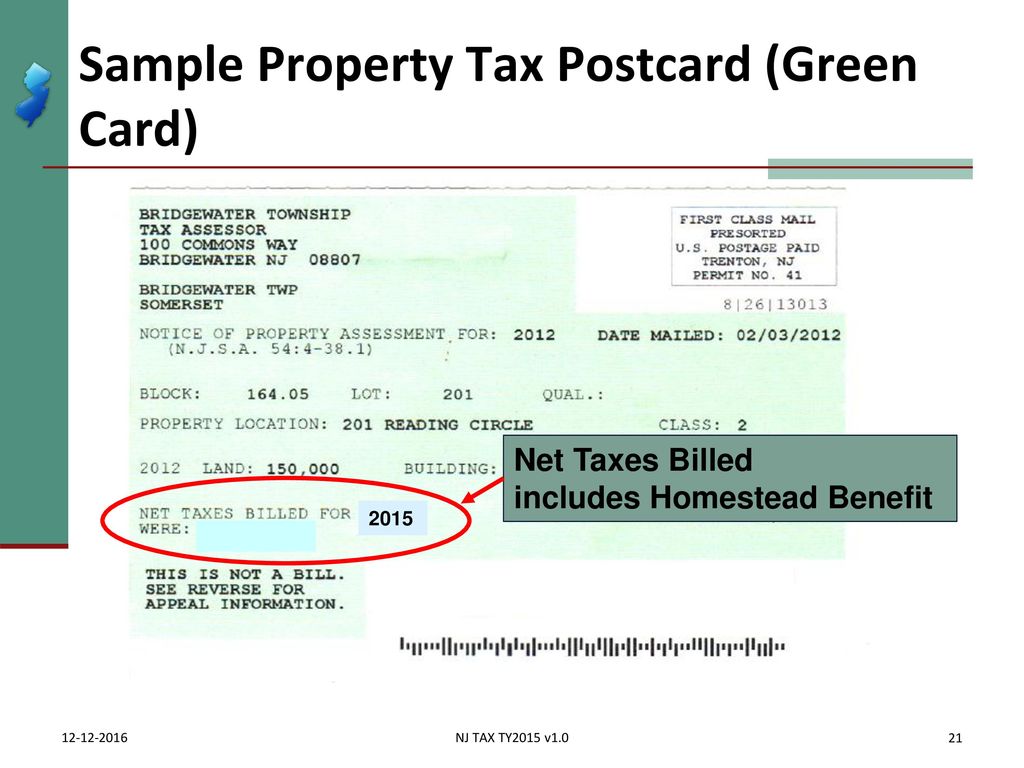

Your tax collector issues you a property tax bill or advice copy reflecting the amount of your benefit. Receiving Homestead Benefits andor Property Tax Credits or Deductions also can receive the Senior Freeze if they meet the eligibility require-ments. The 2021 property tax credits are based on ones 2017 income and property taxes paid.

Homeowners Relief Program is Giving 3708 Back to HomeownerCheck Your Eligibility Today. All property tax relief program information provided here is based on current law and is subject to change. The Homestead Benefit Program.

2018 Homestead Benefit payments should be paid to eligible taxpayers beginning in May 2022. Renters making up to 100000 would be eligible for direct payments up to 250. The main reasons behind the steep rates are high property values and education costs.

Kindly contact the Tax Assessor at 973 403-6028 for more information. If you filed last year and did not receive your application you may be able to get your IDPIN and additional filing information here. Google Translate is an online service for which the user pays nothing to obtain a purported language translation.

If your 2018 New Jersey Gross Income is. Nearly 18 million homeowners and renters would get property tax rebates averaging 700 next year under a new plan Gov. Most recipients get a credit on their tax bills.

Mailing Expected to Begin. Taxation University 609-633-6015. Your benefit payment according to the FY2022 Budget appropriation is calculated by.

You are not eligible unless you are required to pay property taxes on your home. Phil Murphy unveiled Thursday. New Jersey Governor Murphy froze the May 1 2020 Homestead Benefit Program payment in the midst of the COVID-19 pandemic and then cut the program by 142 million.

1-877-658-2972 When you complete your application you will receive a confirmation number. Multiplying the amount of your 2017 property taxes paid up to 10000 by 10. To ask questions please call 1-888-238-1233.

Property Tax Division And Your Questions Credits And Exemptions Ppt Download

Itemized Deductions Nj Property Tax Deduction Credit Ppt Download

Itemized Deductions Nj Property Tax Deduction Credit Ppt Download

Murphy Rolls Out Plan To Cut Property Taxes North Jerseynews Com

Itemized Deductions Nj Property Tax Deduction Credit Ppt Download

Nj Property Tax Relief Program Updates Access Wealth

Nj Property Tax Relief Program Updates Access Wealth

Nj Property Tax Relief Program Updates Access Wealth

Nj Property Tax Relief Program Updates Access Wealth

Nj Property Tax Relief Program Updates Access Wealth

Itemized Deductions Nj Property Tax Deduction Credit Ppt Download

Tax Refund Programs Unfunded Due To Covid S Impact

Itemized Deductions Nj Property Tax Deduction Credit Ppt Download

Gov Murphy Unveils New Property Tax Relief Program Centraljersey Com

Nj Property Tax Relief Program Updates Access Wealth

Deducting Property Taxes H R Block

Assemblyman Here S How 600m Will Benefit The Taxpayer Opinion Nj Com

Itemized Deductions Nj Property Tax Deduction Credit Ppt Download